21+ Tax Preparation Fee Schedule 2021 Pdf

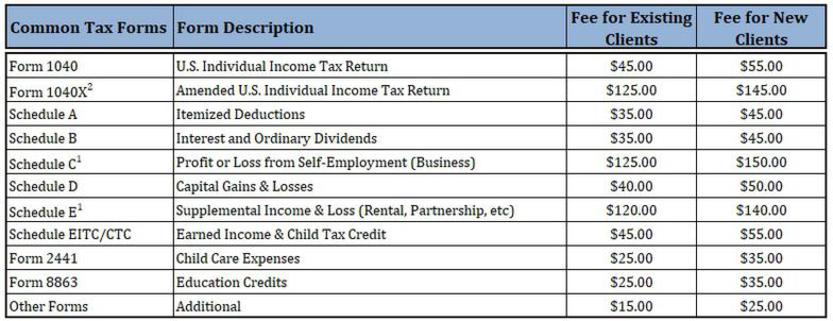

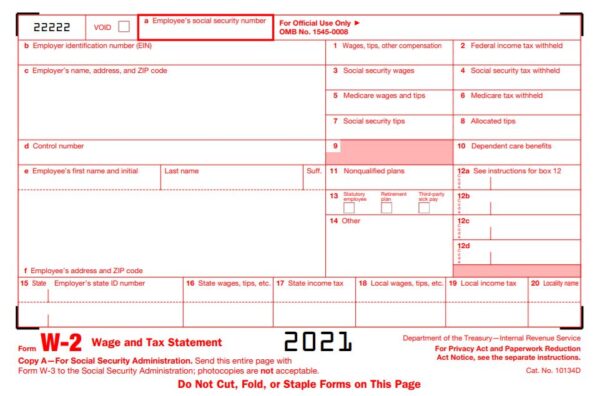

Schedule A Itemized Deductions starting at 25. Form 1040X - Amended US.

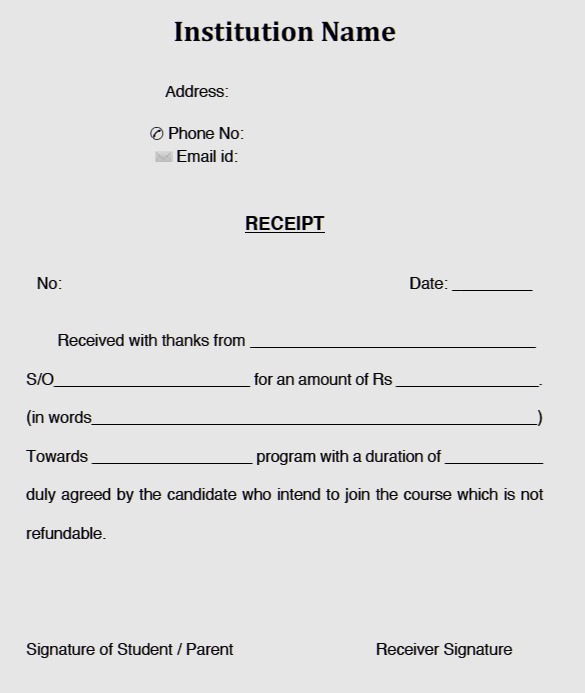

Fee Receipt Format For Coaching Classes In Pdf Word Formats

Schedule B - Interest Ordinary Dividends.

. Schedule B Interest and Dividends 25 per. Schedule SE - Self-Employment Tax. 5 Each 5 Each Schedule C - Profit or Loss from Business 150 Each 200 Each Single Member LLC may require additional charges.

Regulation sections 978970 9789110 9789111. If the required family fee was 100 agencies should report 100. Form 1040 ES Estimated Tax Vouchers.

100 of the tax shown on the 2021 tax return 110 of that amount if the estates or trusts adjusted gross income on that return is more. Form 1040 page 1 and 2 not including state return 75. Schedule F each 15000.

Sitemap Privacy Statement Powered by Superior Court of California County of Alameda. The family fee is 0 Should. Fee Schedule 2020-2021 Please note these fees are subject to change upon initial consultation and review of work needed.

Fee Schedule for Tax Preparation Before Oct 18 2022 BASIC FEE form 1040 and 1040SR 105 up to 4 W-2sItemized Deductions Sched A 50 Sched AInvestment Income Sched. Agencies must report the required family fee whether or not it was actually paid. Schedule H Domestic Employee nanny 50.

Individual Income Tax Return. Up to two W-2s or 1099. Centers for Medicare and Medicaid Services CY 2021 Ambulance Fee Schedule File which contains the following electronic files.

State Return 75 per state. Superior Court of California. 90 of the tax shown on the 2022 tax return or.

Depreciation Schedule each item 500. Tax Return Fee Schedule. The schedules are divided between state and local elections and by committee type.

Form 941to report the employer share and employee share of social security tax and Medicare tax withheld federal income tax and if applicable withheld Additional Medicare Tax. Tax Preparation Fee Schedule Guide Basic 1040 Return preparation fees begin at 425 A return that fits the 425 fee schedule includes the following items. Rental Property Schedule E 35 35 Schedule C Self Employment 35 35 Farm Schedule F 35 Sold Stock 1099B 35 Health Insurance Marketplace 1095A 35 Capital Gains 1099S.

State Returns with a federal return 100 each state Sale of Business or Capital Assets 4797 50. This pricing model is based on the minimum fee structure for our. Form 4562 - Depreciation Amortization.

Federal Return up to 4 W-2s 150. Follow the expandable links below to find the filing schedule that applies to you. Installment Sales form 6252.

LERGY TAX PROFESSIONALS Susan K. Please note that filing. Individual Income Tax Return 15000 Schedule A - Itemized Deductions 4000 Schedule B - Interest Dividend Income 500 per entry 40 minimum.

Normal Tax Return Preparation Fees Genesis Tax Consultants

Tax Preparation

Complete Guide To 2021 Artist Grants Opportunities Artwork Archive

Latvia

Pdf Outpatient Mental Healthcare Service Use Among Women With Migrant Background In Norway A National Register Study

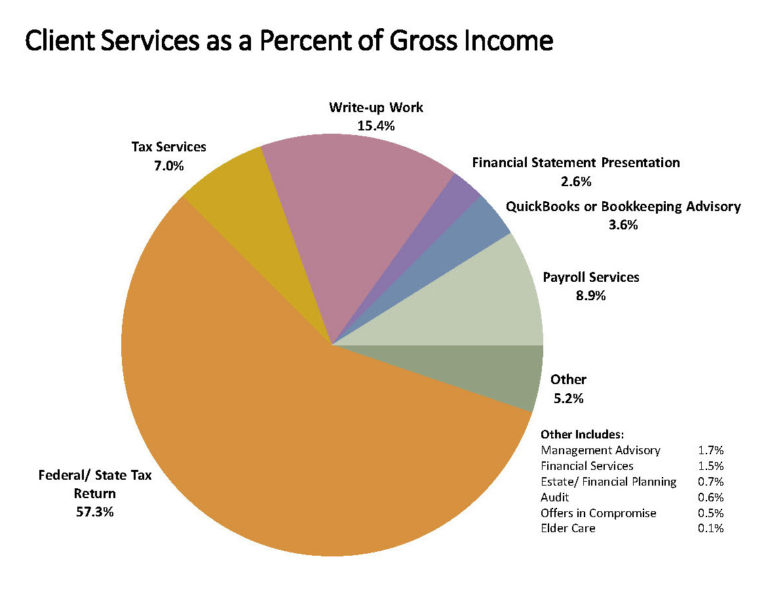

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

How To Improve Tax Prep For Working Americans

Tender Document Aai Pdf Pdf Specification Technical Standard Value Added Tax

Top 10 Issues Facing Cpas 1 Economic Outlook 2 Tax 3 Business

Dew21 Strom Erdgas Warme Und Wasser Aus Einer Hand

Nsa Survey Reveals Fee And Expense Data For Tax Accounting Firms In 2016 And 2017 Projections

Hixhfdsyzssjam

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

File W 2 W2c And 1099 Forms For Churches Clergy Financial Resources

Free Tax Preparation Fee Calculator Intuit Accountants

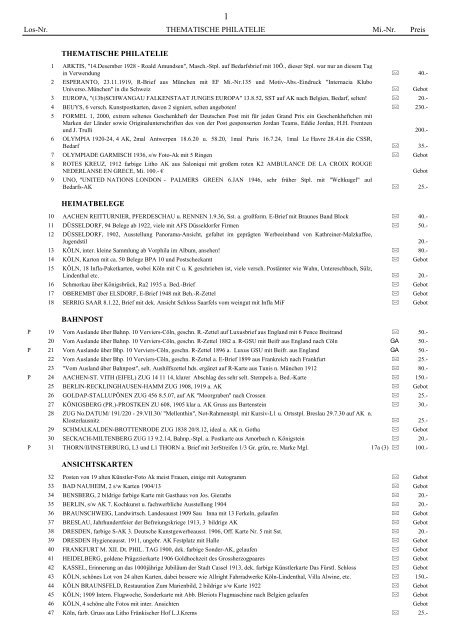

Thematische Philatelie Los Nr Mi Nr Preis Thematische

Ottoseal Silikon S100 Premium 310ml Das Original 8 99